ATTENTION Senior Care Agency Owners:

Free Report Reveals a Smarter Way to Keep Your Books Clean — Without Wasting Hours in QuickBooks

Finally learn what’s really keeping your financials messy — and how to fix it fast so you can focus on growing your business (not reconciling receipts).

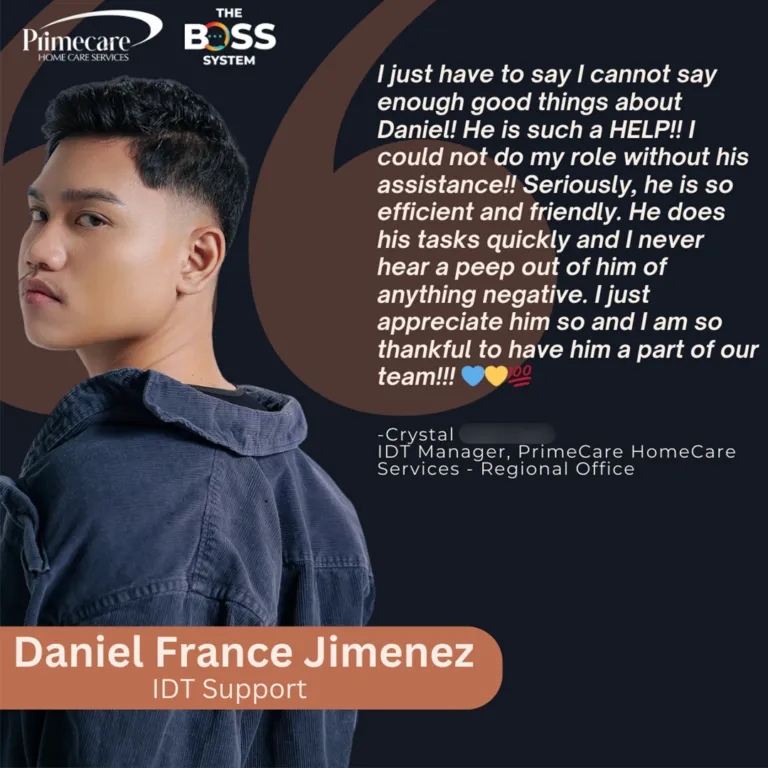

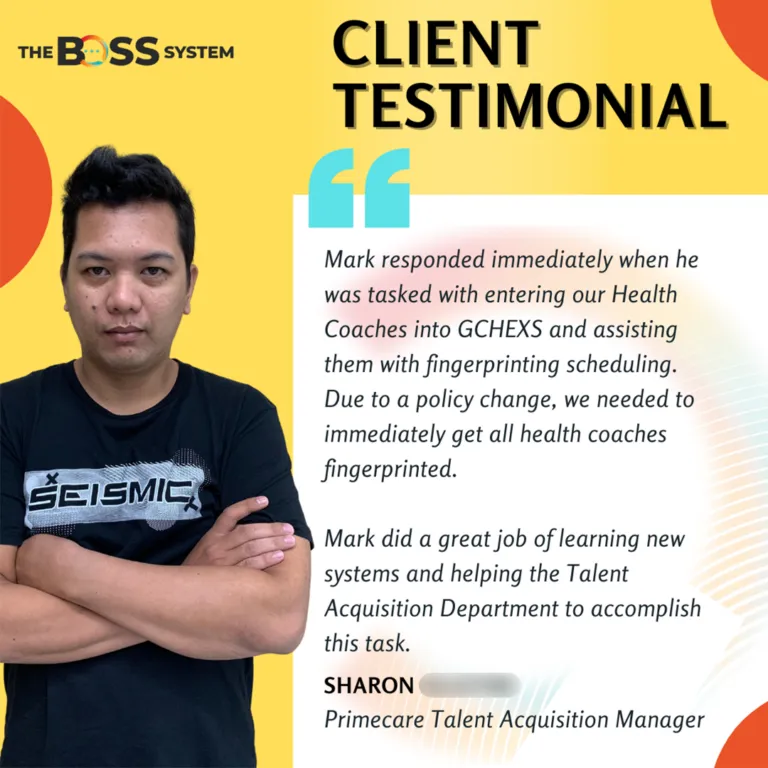

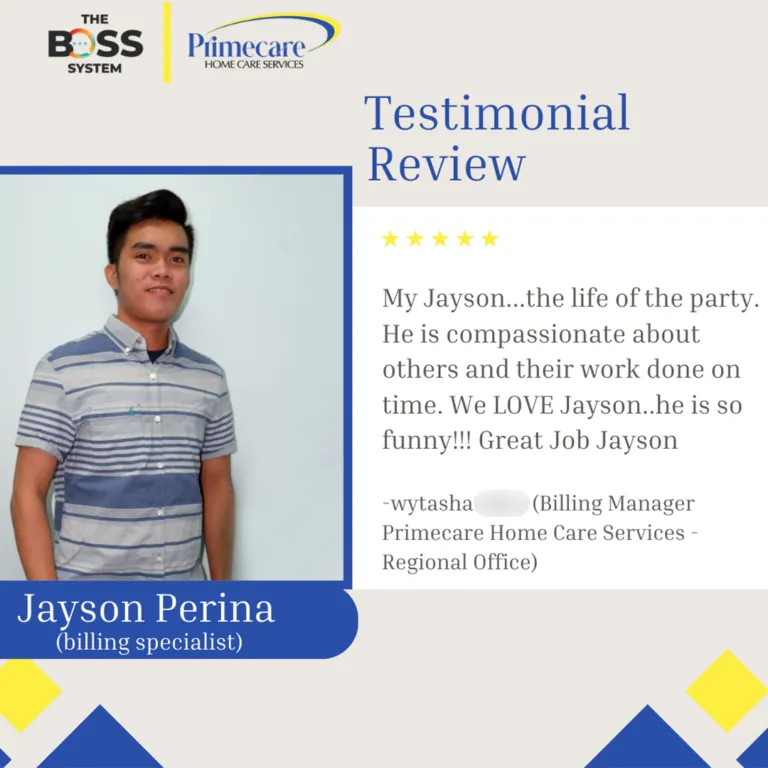

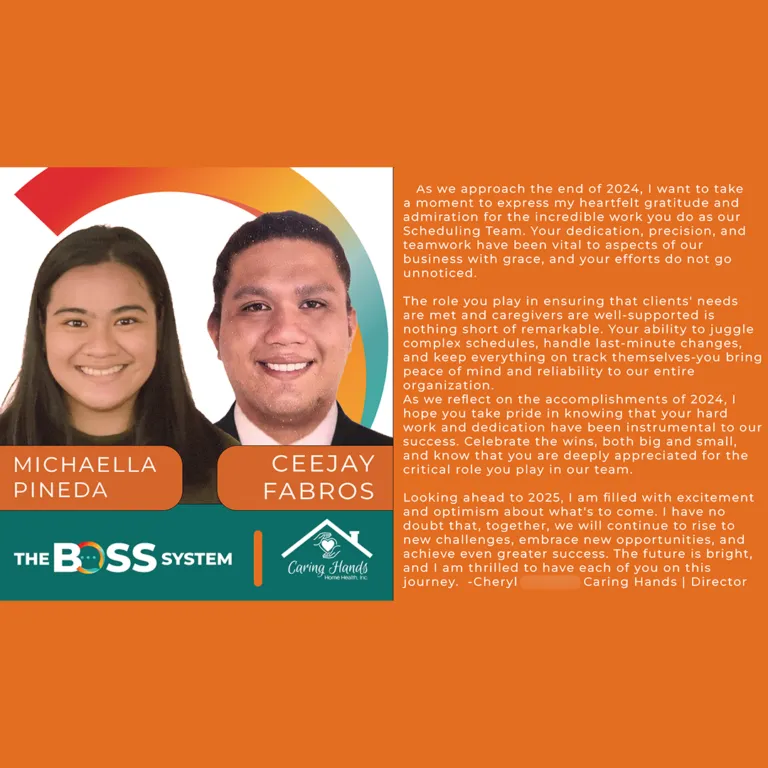

Trusted by Home Care Agencies Worldwide

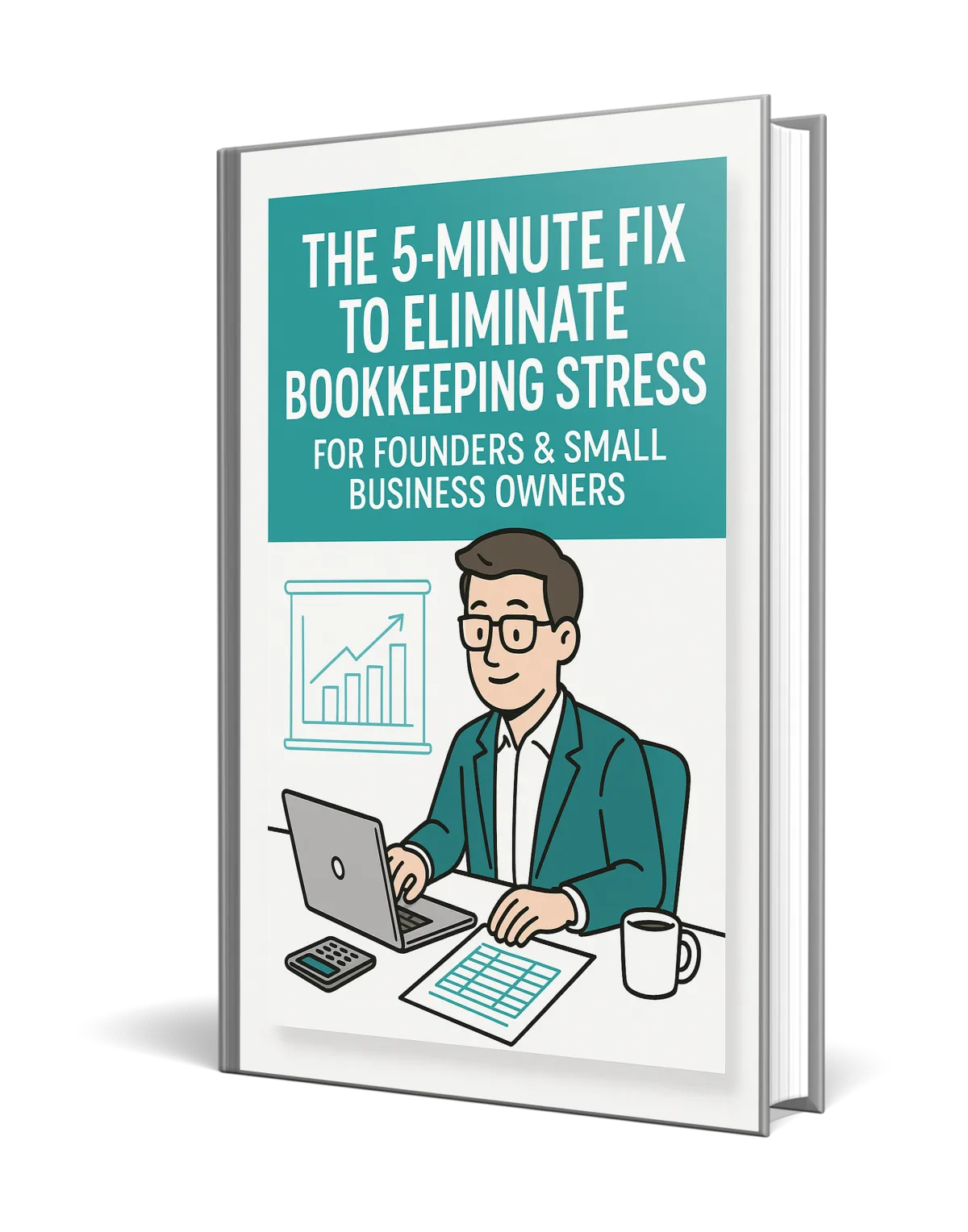

For a strictly limited time you can download a FREE copy of our exclusive report…

5 Costly Bookkeeping Mistakes That Are Slowing Down Your Business

In this no-fluff guide, you’ll discover:

Why most founders unknowingly leave thousands in deductions on the table — and how to stop doing the IRS a favor

The #1 reason DIY bookkeeping causes surprise tax bills (and what to do instead)

What your CPA won’t tell you about messy books and how it affects funding, forecasting, and peace of mind

How to free up 8+ hours per month without hiring in-house or learning new software

And much, much more!

What’s Inside the Free Report:

1

What’s Really Holding Back Most Business Owners Financially

We’ll expose why so many entrepreneurs “wing it” with money — and how that’s hurting their growth more than they think.

2

7 Simple Tips to Stay Tax-Ready Year Round

Practical, fast tweaks that save time, prevent errors, and let you focus on what matters.

3

Why “Doing It Yourself” Isn’t Saving You Money

We’ll show you the real cost of DIY bookkeeping (and a smarter alternative that starts at $149/month).

4

The 3-Step Fix That Takes 5 Minutes to Set Up

This isn’t another software pitch. You’ll learn how smart founders delegate their books without hiring a finance team.

5

What to Avoid If You Want Clean, Audit-Proof Financials

Avoid these all-too-common traps that trigger tax penalties, missed deductions, and investor red flags.

Get Instant Access to This Free Report Now and Eliminate Bookkeeping Stress for Good

Don’t spend another quarter buried in receipts or blindsided by your CPA.